M&A transaction consulting

Secure through purchase, sale and investments

An M&A transaction is no ordinary project. It involves strategic decisions that can change the course of a company. And it is a process that needs to be managed in a calm, structured and determined manner.

You may have experienced a situation that feels familiar to many companies: a potential purchase or sale is on the table, talks are going well, initial documents have been exchanged, and everything actually feels right.

But the deeper you go, the clearer it becomes how much more there is behind a transaction than a good gut feeling. There are financial figures that need to be checked thoroughly, contracts that require detailed work, market positions that need to be realistically assessed and risks that only become apparent after asking a lot of questions.

Suddenly you realize that what initially seemed straightforward quickly develops into a complex web of strategy, negotiation and analysis. This is exactly where professional M&A transaction consulting comes in. It provides security in moments when uncertainty can be costly.

This is because mergers & acquisitions combine economic, legal, tax and cultural issues. If just one of these levels remains unchecked, there is a high risk that the deal will not deliver what it promises. Our approach: We bring clarity to the complexity so that you can make confident decisions without losing sight of your day-to-day business.

Why professional transaction advice is crucial today

The complexity of mergers & acquisitions in the SME sector

Many SMEs have exactly one thing in common: they know their business inside out, but M&A is not part of their day-to-day business. While corporations work with corporate finance teams, in SMEs the burden of responsibility is often borne by the management itself. However, the scope of an M&A process should not be underestimated. A transaction includes company valuation, financial due diligence, risk analysis, deal structuring, contract drafting and negotiations. And each element is decisive in determining whether the deal makes economic sense.

Why strategic decisions require sound analysis and clear management

Most transactions do not fail because the idea behind them is bad. They fail because too few checks were carried out, assumptions were too optimistic or risks only became apparent after closing. This makes it all the more important to set up the process in a structured way. Which deal structure makes sense? What synergies are realistic? How robust is the target company really? A professional analysis prevents decisions from being based on assumptions that are not sustainable later on. It creates the basis on which you can negotiate with a clear conscience.

Why many transactions fail without external support

There is a reason why so many deals are judged to be bad investments in hindsight. There is often a lack of an objective view from the outside. Internally, figures, processes and people are familiar. This makes it difficult to clearly identify risks. An external transaction consultancy looks at companies without operational blindness. It sees patterns that would otherwise be overlooked and asks critical questions about correlations that are quickly overlooked in discussions. This protects buyers and sellers alike.

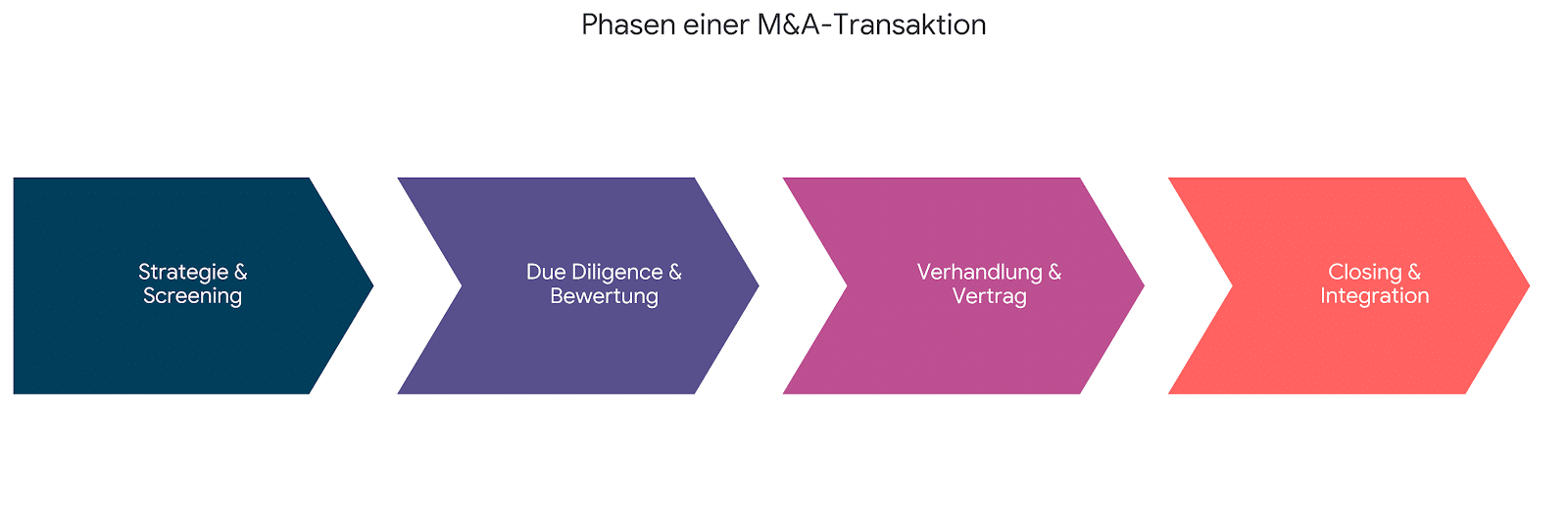

Four steps to cooperation:

1st request

You are welcome to send us your requirements at any time via e-mail or contact form and we will get back to you as soon as possible.

2. analysis

After an initial consultation, we analyze your requirements and check all available options to find the best solution for you.

3. consulting

In an individual consultation, we analyze your challenges and develop a tailored action plan together.

4. implementation

We support you throughout the entire project to ensure smooth implementation.

The typical challenges that companies come to us with

Uncertainty about valuation, risks and the right purchase price

Perhaps you know this feeling: you see potential, but you don’t know whether the price is appropriate. Company valuation is not a gut feeling, but a combination of figures, market potential, competitive environment and risk profiles. The greatest danger arises when risks remain invisible. We create transparency before decisions are made.

Lack of internal capacities for due diligence and transaction process

Due diligence requires resources. It requires attention, experience and a system that recognizes where risks are hidden. Most companies have no free capacity for this in their day-to-day business. We take over the structuring, analysis and coordination. So your team remains capable of acting.

Difficult negotiations and unclear transaction structures

Negotiations are rarely straightforward. Buyers and sellers pursue different goals, and that is normal. It is crucial to have a clear, fact-based line of argument that strengthens your own position. We prepare negotiations and accompany them so that you can act confidently and confidently at all times.

Time pressure and information asymmetries

In transactions, things often happen faster than you expect. And that’s when the one piece of information that could change everything is sometimes missing. We build a process that provides certainty, even when the market or the other side generates pressure.

Complex legal, tax and financial requirements

No M&A process can do without experts. Whether legal due diligence, tax due diligence or ESG risks: All of these areas influence the deal value. We coordinate all specialists so that you only have one point of contact and yet all relevant areas of due diligence are covered.

Risks in post-merger integration

Many underestimate the time after the closing. Processes, systems and cultures have to come together. If this does not succeed, the deal loses value. We help plan the integration in good time so that the transition goes as smoothly as possible.

Our solution: M&A transaction advice that creates clarity, security and structure

A central point of contact for the entire process

Instead of having to coordinate several consultations, you have one person who bundles, structures and supports everything. This creates clarity and reduces effort.

Clean analysis and transparent evaluation

We look at financial figures, business model, market position, competition, synergies and risks. Our goal is a realistic assessment that protects you from surprises.

Strategy development and deal structuring

Whether asset deal, share deal, participation or joint venture – we develop a model that makes economic and legal sense. This allows you to retain control over risks and opportunities.

Careful coordination of all due diligence areas

We ensure that financial, legal, tax and ESG due diligence work together seamlessly. This creates a holistic picture of the target company.

Support with purchase price determination and negotiations

We develop a clear line of argument and accompany negotiations so that you can act confidently at every stage.

Support until closing – and into integration

The deal does not end with the signature. We also support the transition phase so that structures, processes and teams come together.

What our M&A transaction advice specifically includes

- Strategic preparation and M&A readiness

- Company valuation and analysis of future viability

- Equity story or purchase argumentation

- Development of the optimal transaction structure

- Risk analysis and evaluation of all test areas

- Preparation and support of contract negotiations

- Support with financing issues or finding investors

- Planning and support for post-merger integration

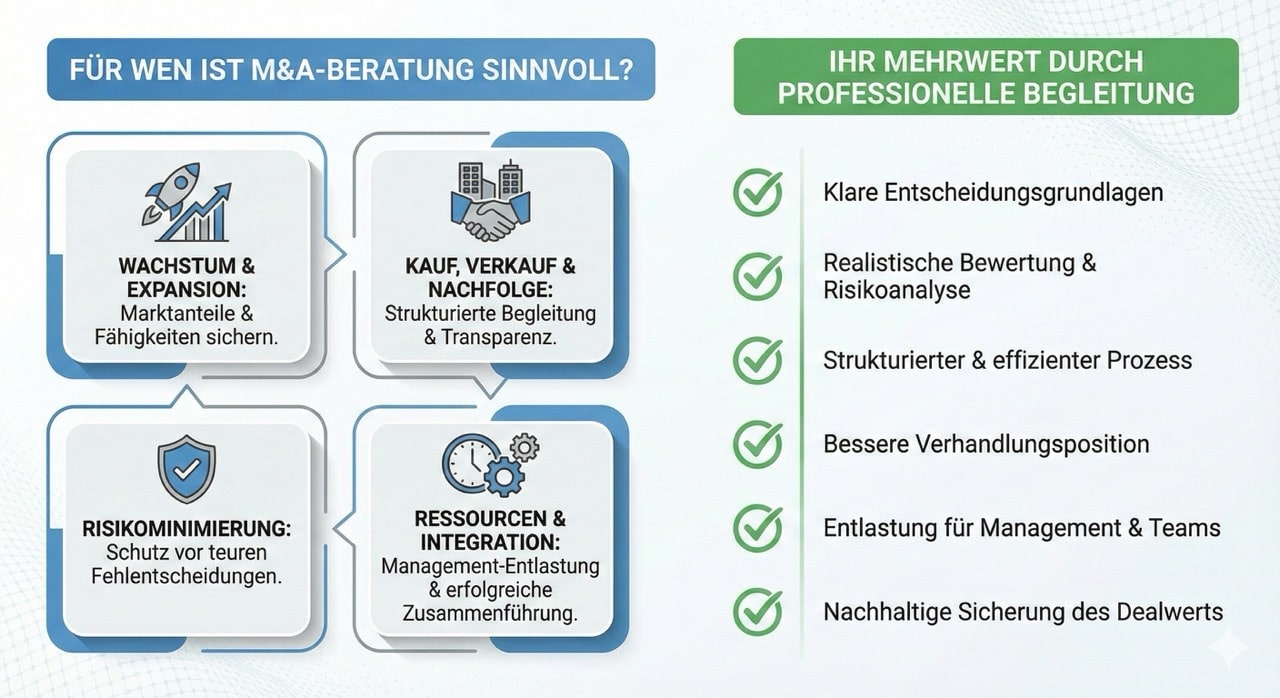

For whom M&A transaction consulting is particularly useful

Companies that want to grow or expand

If you want to buy additional market share or skills, you need a secure process.

Companies wishing to acquire a target company

We provide support from analysis and due diligence through to integration.

Owners who are selling or planning a succession

We provide structure, transparency and professional support.

Companies that want to minimize risks

Our analysis protects against wrong decisions that could prove costly later on.

Companies that need support with integration

Cultural and organizational integration determines success or failure.

Management teams without free capacity

We take control so that everyday life can continue.

Your benefits from professional M&A transaction advice

- Clear basis for decision-making

- Realistic assessment and transparent risk analysis

- Structured and efficient process

- Better negotiating position

- Relief for management and teams

- Sustainable safeguarding of the deal value

Why companies choose us

We bring calm to complex situations

We work in a structured, clear manner and without unnecessary complexity.

We manage a network of specialists

You have one contact person, we take care of the coordination.

We think holistically

From analysis to integration, everything remains in line.

We accompany changes until they take effect

Our claim does not end with paper, but with results.

We act in the interests of our customers

Independent, experienced and practice-oriented.

Why li2pps?

Choose us and benefit from our customized full-service approach to your product based on your individual needs, because we understand that every challenge is unique.

Low use of resources for maximum effect

Pragmatic and efficient problem solving

Customized and individual implementation

Creative marketing strategies with well-founded market analyses

Strong international network of experts

Full-service approach, from the idea to implementation and support.

FAQ

Our FAQ section offers you valuable insights into our services and working methods. Here you will find answers to frequently asked questions. Transparency is important to us – discover the information that will help you make the best decision for your company.

1. what exactly is discussed in the initial consultation?

In the initial meeting, we would like to better understand your current situation, goals and challenges in product and marketing management. Among other things, this involves

- Your existing products or services

- Your target groups and market positioning

- Previous marketing measures and their results

- Your strategic and operational goals

- Expectations of a possible collaboration

The meeting serves to get to know each other and forms the basis for an individual consulting concept. It is, of course, non-binding.

2. what information is required so that a binding offer can be prepared?

We need a few basic details to provide you with an accurate and binding offer:

- A brief description of your company and what you offer

- If available, information on your current product and marketing strategy

- Your specific goals and challenges (e.g. which target markets, target groups, companies, visibility, market awareness)

- The desired scope of services and focus (e.g. consulting, strategy development, implementation)

- Time frame and budget

With this information, we can realistically estimate the project costs and prepare a customized offer.

3. what is the typical project duration?

The duration of a project depends heavily on its scope and complexity. As a rule, our projects last between 4 weeks and 6 months.

- Short projects such as workshops, analyses, raising awareness, etc. : a few weeks

- Strategic projects or market launches: several months

At the beginning, we work with you to define a clear roadmap with realistic time frames and milestones.

4. do you also work with existing agencies or internal teams?

Yes, definitely. In fact, close cooperation with your internal teams or existing agencies is very important to us. We see ourselves as a complement, not a substitute.

Whether it’s a matter of strategic coordination, operational implementation or the further development of existing measures: we integrate ourselves flexibly into your existing structures and bring in fresh impetus from outside. The goal is always efficient, goal-oriented cooperation at eye level.

5 What does a consultation cost and how is it billed?

The costs depend on the scope, duration and individual service requirements of your project. As a rule, we offer three billing models:

- Daily rate for selective services, workshops or project-related consulting

- Package deals for clearly defined projects with a fixed scope of services

- Monthly retainers for continuous, flexible support over a longer period of time

You will of course receive a transparent, binding offer in advance with no hidden costs.